EMC has released its fourth quarter and full year earnings for 2015. Unlike several of the news pieces we’ve covered recently (such as Violin Memory, Nimble, and to a certain degree IBM) EMC’s earnings are looking pretty good. As the deal with Dell acquiring EMC for $67 billion is still going through according to Joe Tucci, EMC Chairman and CEO, EMC will become a privately held company and will no longer have to report its earnings.

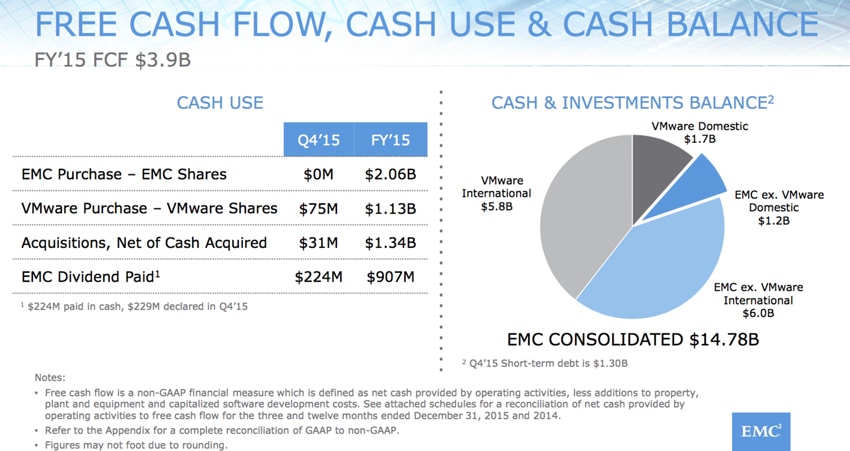

Looking at the fourth quarter earnings revenue was $7 billion, which is flat year over year. GAAP net income was $771 million (non-GAAP income was $1.3 billion in 4Q) and GAAP earnings per weighted average diluted share was $0.39 in the fourth quarter (non-GAAP earnings per weighted average diluted share was $0.65 in 4Q). EMC also generated $1.9 billion in operating cash flow and $1.5 billion in free cash flow in 4Q. At the end of the quarter EMC had $14.8 billion in cash and investments and returned roughly $229 million to shareholders through dividends.

Looking at the full year, GAAP revenue was up 1% year over year at $24.7 billion (non-GAAP revenue was $24.8 billion). Net income was $2 billion GAAP and $3.6 billion non-GAAP. This makes their earnings per weighted average diluted share was $1.01 GAAP, and $1.82 non-GAAP.

A few other highlights from the report include VMware’s 4Q and full-year revenue were up 10% and 9% year over year, respectively. Pivotal’s 4Q revenue is up 25% year over year and its annual recurring revenue is up 40% compared to the previous quarter. EMC XtremIO ended the year with over $1 billion in revenue. And VCE exited 2015 with an annualized demand run rate exceeding $3 billion.

While it was mostly good news there were a few misses (EMC can’t win them all). EMC Information Infrastructure’s 4Q revenue was down 4% year over year with its full-year revenue being down 2%. Information Storage was also down 4% in 4Q year over year with its full year being down 1%. Consolidated 4Q revenue from North America, Asia Pacific, and Japan was flat, Europe, Middle East and Africa region was down 1%, and Latin America revenue was down 16% year over year.

Amazon

Amazon