Today at Dell Technologies World 2018, Pivotal Software, Inc. announced its Built to Adapt Benchmark report, commissioned by Longitude Research Ltd, a Financial Times Company, and Ovum Ltd. The benchmark is designed to gauge how well an organization builds software that delivers business value. Pivotal has been using the benchmark over the last year to assess the software development proficiency of companies across five industries and six countries and included 1,659 information technologists.

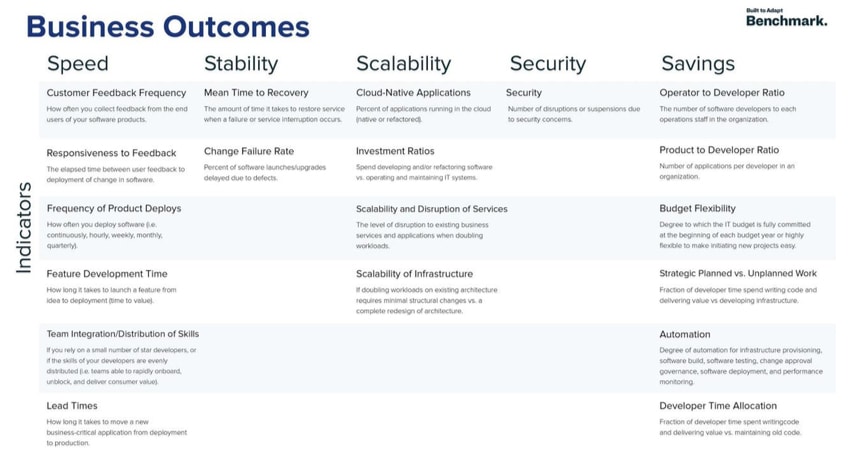

Software needs to deliver business value if it is to be deemed worthy of implementing in a business setting. The benchmark announced today is designed to figure out how well software works and looks at five outcomes: Speed, Stability, Scalability, Security, and Savings. These five outcomes more or less cover the spectrum of business needs as companies are looking more and more to become software-defined.

Key findings include:

- Speed:

- US firms polled are most likely to get continuous or daily feedback from customers (52%) as opposed to 43% in Germany and 38% in the UK.

- 54% of US firms polled are deploying code on a continuous, hourly or daily basis. That fares well against the global average polled of around 38%, but well behind Germany, where 72% of firms polled are deploying on a continuous, hourly, or daily basis.

- Stability:

- Of the US firms polled, it takes an average of 61 days to restore service after a major failure or service interruption. In particular, the very high mean time to recovery reported by telecoms (91 days), retail (72 days), and insurance (58 days) firms polled bring this metric up.

- US firms report approximately 22% of their software launches or upgrades are delayed due to defects.

- Scalability:

- 45% of applications run by US firms polled have been built or refactored to run in the cloud, compared with between 31% (Germany) and 38% (Australia) across other markets surveyed.

- Only in the US are half of firms (51%) polled spending more on developing new and/or refactoring legacy software than they are on maintaining existing IT systems. In the UK and Germany, just 43% and 44% of firms polled are managing the same.

- US firms polled offer a mixed picture on scalability.

- More than half of US firms (55%) polled stated scaling their infrastructure to accommodate a doubling of workloads would require minimal structural changes, compared with an average of 38% across all markets polled.

- However, one-third of those firms (32%) say doing so would result in extremely high levels of service disruption, compared with an average of 16% across other markets polled.

- Security:

- 33% of US companies polled reported having new or existing apps paused 11 or more times in the past year due to security concerns, as opposed to only 12% in Germany or 15% in UK.

- Savings:

- US IT budgets are among the least flexible, with half of polled firms (50%) saying budgets are fully committed at the start of the year, making it difficult to initiate projects mid-cycle.

- US firms are leading the way on automation, with more polled firms than anywhere else:

- Performance monitoring is mostly or fully automated at 70% US firms, compared with an average of 53% across all markets (highest 60% in Germany, lowest 36% in Japan).

- Infrastructure provisioning is mostly or fully automated at 58% US firms, compared with an average of 37% across all markets (highest 46% in Germany; lowest 17% in Japan).

- Software testing is fully or mostly automated at 56% US firms, compared with an average of 42% across all markets (highest 50% in Germany; lowest 29% in Japan).

- US software teams polled have an average of more than 6 software developers to every operations/QA team member, compared with between 3–4 in APAC.

- US developers polled are spending more time (42%) than elsewhere writing code for new products and features, as opposed to carrying out maintenance of troubleshooting old code.

Amazon

Amazon