Pure Storage has announced its fourth quarter earnings for 2017 as well as its year on year earnings. Some of the numbers, such as revenue and gross margin, are up from the last quarter and the previous year. However the company is still operating at a loss. And its stock took a sharp nosedive after yesterday’s announcement, speeding up a trend that has been going on for a while now of its stock price decline.

Image courtesy of Google Finance

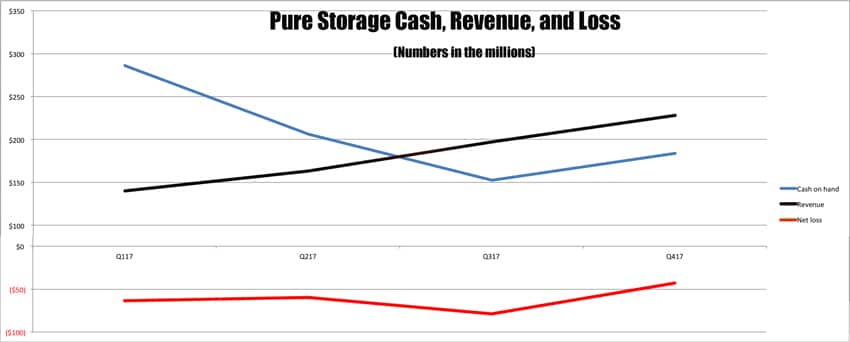

Looking at this quarter’s numbers, revenue was $227.9 million up from last quarter’s $197 million and the same time last year, $150.2 million. Gross margin was 65.3% GAAP this quarter, up a bit from last quarter’s 64.8% and flat from this time last year (non-GAAP gross margin 66.1% up from last quarter’s 65.5% and up slightly from this time last year, 66%). GAAP Net loss was -$42.9 million, an improvement over last quarter’s -$78.8 million, but it is still a loss. Non-GAAP net loss was -$4.8 million again an improvement over last quarter’s -$20 million.

For the year, Pure is reporting $728 million in revenue and a net loss of $245.1 million. Revenue is way up from this time last year; $440.3 million but net loss last year was $214 million. Cash and cash equivalents went from $605 million last year to $184 million this year or about a 70% reduction in a year.

Since going public in October of 2015, Pure has been able to pull off fairly good earnings reports when a lot of other tech companies have been struggling. One obvious issue is that they seem to always be running a net loss. Revenue going up every three months is a good thing, especially when it exceeds expectations. However, if this incoming cash isn’t high enough to offset all of the costs, the company will eventually run out of cash and then potentially go out of business. It is unclear what Pure’s end game is, whether there is a definitive plan to start turning a profit or if they would be open to a merger or acquisition by another player. Time will tell.

Amazon

Amazon