451 Research ran a survey on datacenter trends in for the second quarter of 2015 and found that a majority, 87%, of datacenter operators are maintaining or increasing their spending on their datacenter facilities. Not only are operators still spending on datacenter facilities, the study found that 25% are expected to increase their spending in the next 90 days. The survey was conducted on datacenters operators in North America and Europe. The results are somewhat surprising given all the recent investments in cloud and colocation providers.

The majority of the growth in spending will come from the healthcare and finance industries. And the main focus of the spending will be on rack and cabling, power equipment, and datacenter infrastructure management software (DCIM). Operators feel that upgrades such as DCIM will enable them to run their datacenters more efficiently. As datacenters upgrade and repair/replace older equipment, it opens up an opportunity for vendors to take advantage of this trend.

Of those surveyed, the preferred provider in facility equipment and software categories was Schneider Electric, that providing UPS, PDU, racks and cabling, as well as DCIM. Schneider was following closely by Emerson Network Power (Emerson was number one in preferred air conditioning and air handling equipment provider). Other higher ranked vendors include: Carrier, Caterpillar, Eaton, HP, and Trane. As the StorageReview Test Lab has grown, we have used Eaton for our rack and power needs.

While organizations are investing more in datacenters, they are also starting to consolidate their datacenters more and more. In the next few years, several organizations plan on closing the smaller datacenters and server rooms and consolidate them into a more centralized model. Instead of having several smaller locations, most companies are opting for cloud and colocation resources.

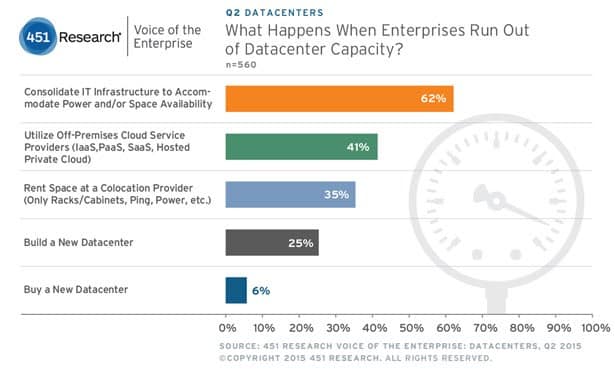

Datacenters are becoming more centralized, making more, larger datacenters but the total overall datacenter square footage owned by enterprises is flat worldwide. Once organizations reach 75% datacenter utilization, they need to consider additional capacity. Since the trend is now fro larger centralized datacenters, the increased capacity will most likely come from cloud and colocation resources. Once again this creates an opportunity for vendors that sell, create, and support those resources.

Amazon

Amazon