Intel introduced its upcoming client processor, Panther Lake, at the 2025 Tech Tour in Arizona. The new chip, part of the Intel Core Ultra Series 3, is the first to be built on the company’s 18A semiconductor process. This significant milestone coincides with the start of high-volume manufacturing at Intel’s recently completed Fab 52 facility in Chandler.

Fab 52: A $32 Billion Commitment to Domestic Production

Panther Lake and Clearwater Forest are both being manufactured at Intel’s newest fabrication facility, Fab 52, located at the company’s Ocotillo campus in Chandler, Arizona. The plant is a centerpiece of Intel’s broader $100 billion initiative to expand U.S.-based semiconductor production and reduce offshore exposure for both Intel and its foundry customers.

Construction began in late 2021, with excavation on the scale of roughly 400 Olympic-sized pools and material use exceeding that of the Burj Khalifa, underscoring the plant’s size and complexity. It now stands as a critical capacity node for Intel’s most advanced chip-making technologies.

Fab 52 joins a growing domestic footprint that includes advanced R&D in Oregon and packaging operations in New Mexico. Together, this network provides a strategic manufacturing base for client and server products, as well as for Intel Foundry customers seeking high-volume, leading-edge production within U.S. borders.

Next-Gen Chips at the Heart of U.S. Manufacturing Push

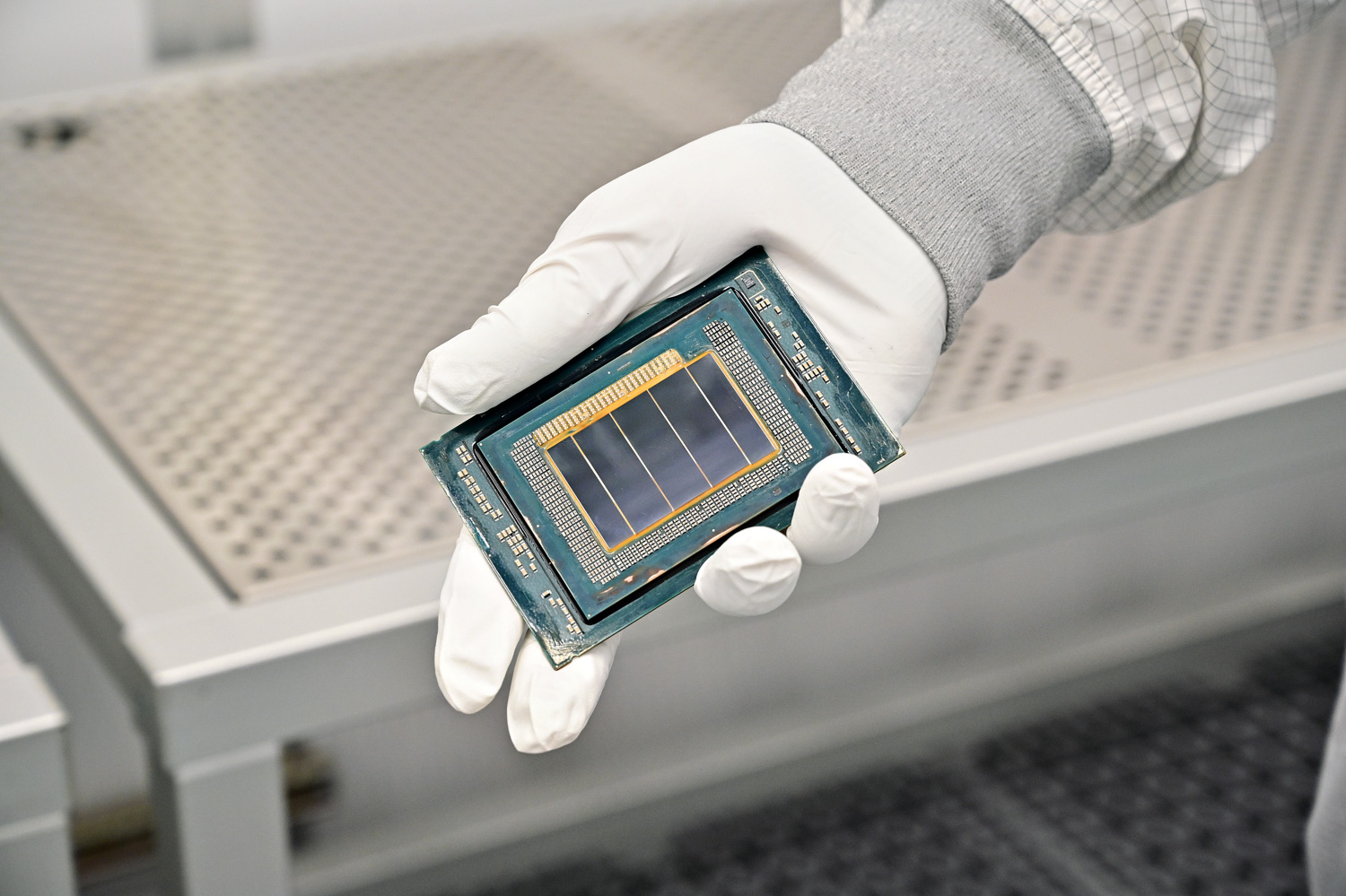

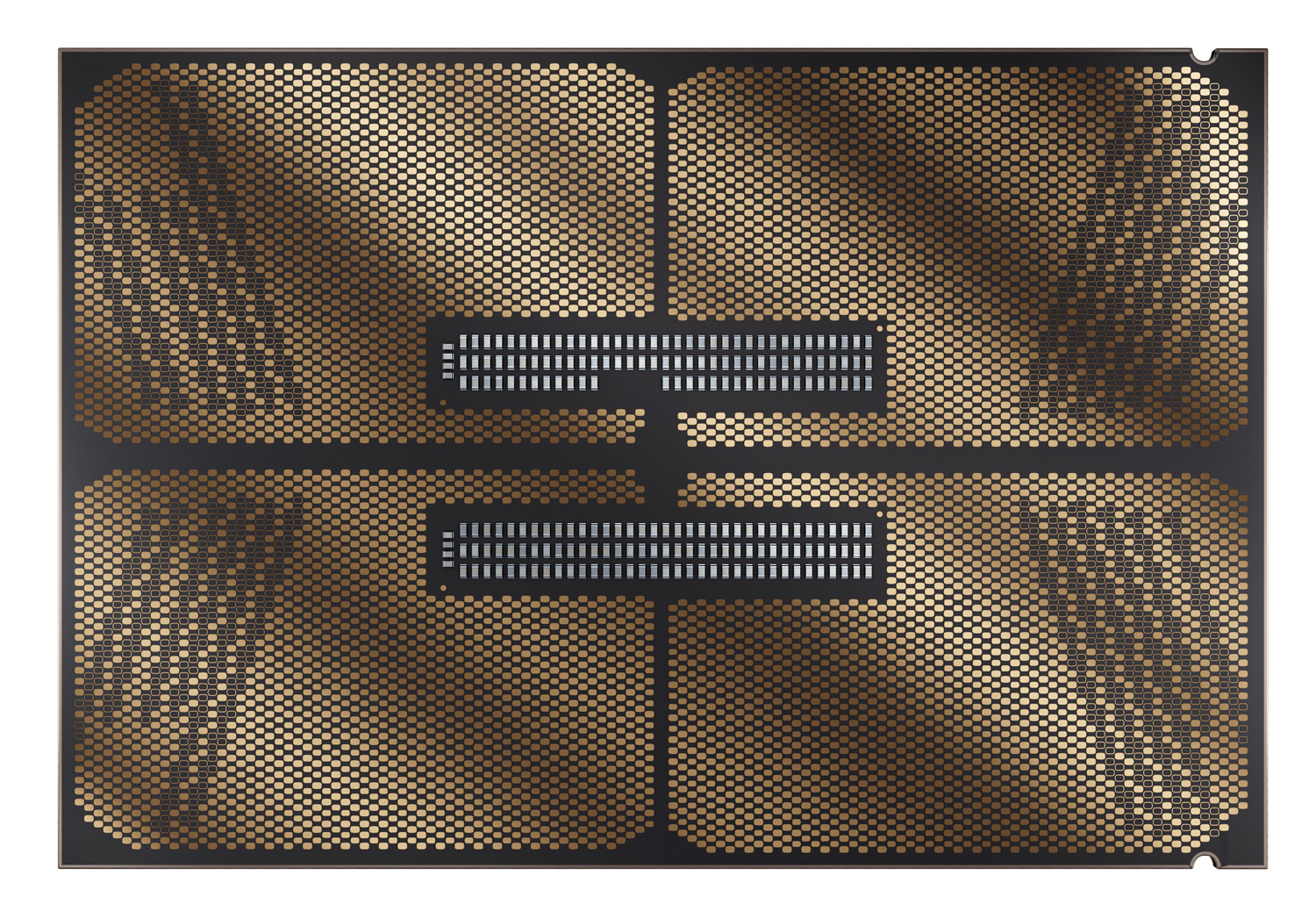

Panther Lake is positioned as the foundation for Intel’s next-generation AI-enabled PCs and edge devices. Built on the Intel 18A process, it utilizes a modular multi-chiplet design that enables OEMs to fine-tune thermals, features, and cost across a wide range of systems, from thin-and-light laptops to high-performance desktops and industrial edge solutions.

Now in production, Panther Lake will be available in three main SKUs, covering ultraportable, workstation, and high-performance desktop tiers. Each model shares the same disaggregated architecture but varies in GPU configuration, memory support, and power profile. The platform integrates a 12-core Xe3 Arc GPU and a balanced CPU-GPU-NPU design built for AI workloads, delivering up to 180 combined TOPS (around 120 from the GPU and more than 50 from the fifth-generation NPU).

Connectivity and memory support see a full refresh. Native options include Wi-Fi 7, Bluetooth 5.4, PCIe Gen 5, and Thunderbolt 5 for high-bandwidth peripherals. Additionally, LPDDR5x-9600 and DDR5-6400 memory are supported, with capacities of up to 128 GB. This range allows OEMs to scale from battery-efficient ultrabooks to creator-class systems. Combined with NPU 5’s dedicated AI compute and Intelligent Bias Control for fine-grained power management, Panther Lake shapes up as Intel’s most balanced mobile architecture yet, blending performance, efficiency, and connectivity within a single, scalable SoC.

Panther Lake targets the same class as AMD’s Ryzen AI systems based on Zen 5 and 5c, where integrated NPU and GPU capability will be a key differentiator. Intel is emphasizing low-power local inference and responsive performance in creative workflows, video upscaling, and browser-based AI tasks. As AMD gains design traction for Copilot+ PCs, Intel’s ability to deliver real-world efficiency, AI responsiveness, and software readiness will become critical to adoption.

For edge use, Panther Lake extends to robotics and industrial AI deployments. Intel is pairing the platform with a Robotics AI software suite and a reference board that merges control and perception on a single chip, cutting cost and complexity for autonomous and machine-vision applications.

Inside the 18A Process Node

Intel 18A marks the transition to 2nm-class chip manufacturing. Developed in the U.S. and now entering high-volume production in Arizona, 18A introduces two key innovations:

- RibbonFET, Intel’s first gate-all-around transistor architecture, and

- PowerVia, a backside power delivery system that reduces interference and improves energy efficiency.

Compared to Intel 3, 18A targets up to 15 percent better performance per watt and about 30 percent higher transistor density. These gains enable higher core counts, better battery life, and greater AI workload performance across both PCs and servers.

Foveros 3D packaging enables Intel to combine CPU, GPU, NPU, and IO tiles in a single package and even mix process nodes as needed. This approach enables the mixing of nodes, tuning of system-level performance, and acceleration of time-to-market for a broader range of SKUs.

Intel says 18A will support at least three upcoming client and server generations, providing OEMs with a clearer runway for their designs.

Fab 52 and Environmental Design

Beyond its role in chip production, Fab 52 includes a 12-acre water treatment and recycling facility developed in partnership with the City of Chandler. The facility can treat up to nine million gallons per day, supporting Intel’s goal of maintaining a water-positive footprint in Arizona. In 2023 alone, Intel returned over one billion gallons of water to the state’s watershed.

These environmental efforts are part of Intel’s broader sustainability strategy, aiming to align advanced manufacturing with resource stewardship and community partnerships.

Looking Ahead: Execution Will Define Success

Intel says it’s banking on its U.S. expansion and chiplet-based architectures to reassert leadership in client and server computing while strengthening supply chain resilience. However, with competitors like AMD consistently delivering and NVIDIA maintaining substantial platform leverage in AI systems, Intel’s near-term challenge lies in execution.

Key markers include 18A yields in shipping systems, Panther Lake battery life under AI-assisted workloads, software stack maturity, and the pace of OEM rollouts.” For servers, factors such as memory bandwidth per core, platform TCO, and virtualization stability will all play a role in determining whether Clearwater Forest can gain a meaningful share.

AMD and NVIDIA Outlook

In the near term, AMD maintains an execution and availability edge with Zen 5 and 5c Ryzen AI designs showcasing strong NPU and RDNA graphics, and the broad 2026 window for Panther Lake provides AMD time to iterate. For NVIDIA, Intel’s 18A cadence and packaging are positioned as complementary to GPU-centric stacks, with CPUs orchestrating data prep, I/O, security, and scheduling. At the same time, tighter PCIe and CXL coupling keep accelerators saturated. Market adoption will hinge on proof of 18A yields and clocks in shipping systems, real battery life under mixed CPU, GPU, and NPU workloads, ISV readiness for common AI paths, and how fast OEMs roll out validated configs. If Intel achieves those marks, buyers will gain credible CPU options for AI PCs and dense-scale-out servers without disrupting existing NVIDIA-led training and inference pipelines.

Amazon

Amazon