Nutanix Inc. reported its earnings for the third quarter of its fiscal year that ended April 30, 2018. Overall the company had good numbers and a fairly good quarter considering they are transitioning to software defined. Their stock, like most other tech stocks in the current market, took a beating. This may have more to do with the mood of the market and less to do with anything reported by Nutanix.

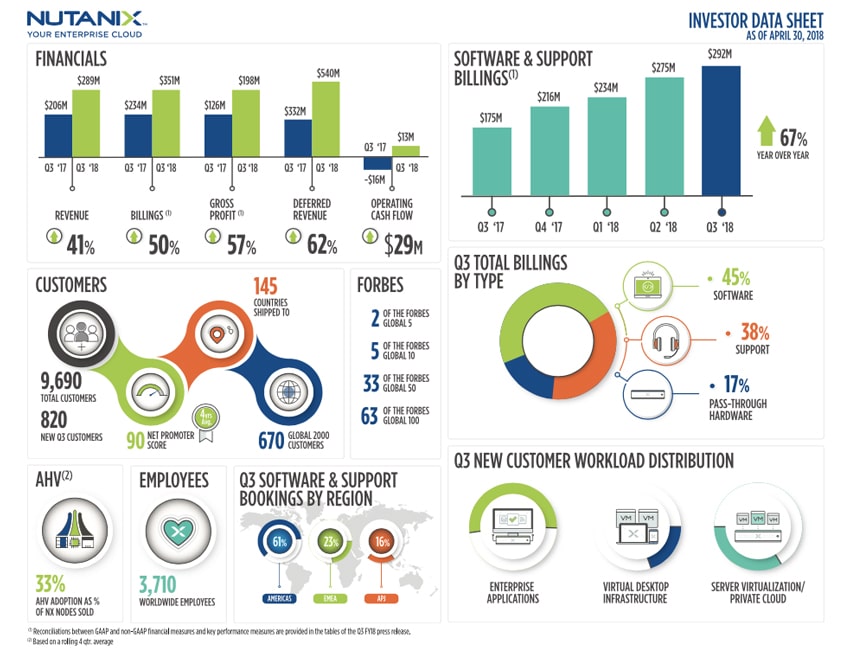

Looking at the numbers, Nutanix reported revenue of $289.4 million up 41% from the same time last year while reflecting the elimination of roughly $52 million in pass-through hardware revenue. The company saw a net loss of $85.7 million GAAP ($0.51/share) and $34.6 million non-GAAP ($0.21/share), both an improvement over the same time last year. Nutanix reported cash and short-term investments at $923.5 million; up significantly form the same time last year. The company saw a dip in operating cash flow, $13.3 million, and free cash flow, $800,000 compared to this time last year.

On the non-numbers side of the quarter, things looked up for Nutanix. They acquired the application discovery and operations management company, Netsil, Inc. Continued on their transition to a software-defined company, seeing software and support billings go up by 67%. And they were able to add nearly a thousand new customers bringing the total to 9,690 end-customers.

For the fourth quarter the company is expected revenue between $295 and $300 million, non-GAAP gross margin in the range of 73%-74%, non-GAAP operating expenses between $250 and $260 million, and non-GAAP net loss between $0.20 and $0.22 per share.

Amazon

Amazon