Today Nutanix Inc. reported earnings for its fourth fiscal quarter as well as its fiscal year that ended July 31, 2018. The numbers reported overall weren’t bad, however the company did lower its expectations for next quarter. Its stock is up slightly for the quarter, though it saw a sharp drop off in after hour trading.

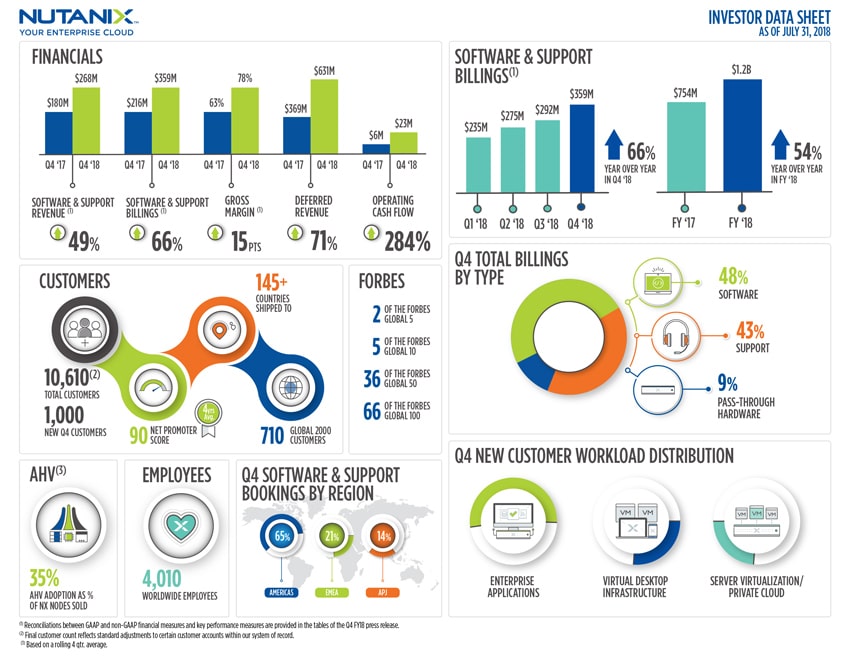

Looking at the numbers for the quarter, Nutanix reported revenue of $303.7 million up from the same time last year as well as last quarter. This number reflects the company’s elimination of roughly $95 million in pass-through hardware revenue. The company saw a net loss of $87.4 million GAAP (or $0.51/share) and $19 million non-GAAP (or $0.11/share), both an improvement over this time last year. Gross margin was reported as 75.9% GAAP and 77.7% non-GAAP, again up form the same time a year ago. Operating cash flow saw an improvement to $22.7 million with free being $6.5 million.

The numbers for the year showed a revenue of $1.16 billion a jump from 2017’s $845.9 million, again the number reflect the elimination of pass-through hardware revenue. Nutanix had a net loss for the year of $297.2 million GAAP (or $1.81/share) and $101.5 million non-GAAP (or $0.62), an improvement over the net losses of the previous year. Gross margin was 66.6% GAAP and 68.1% non-GAAP. Operating cash flow was $92.6 million a big jump from last year’s $13.8 million and free was $30.2 million.

It has been a fairly good year and quarter for the company. They acquired the DaaS Company Frame just recently. As stated above, they were able to brake the coveted $1 billion mark in revenue. And they have expanded their customer base to over 10,000.

Looking forward to the next quarter, Nutanix is expected revenue to fall between $295 and $310 million with billings between $370 and $390 million. The company is looking for non-GAAP gross margin of 78-79%, non-GAAP operating expenses between $280-$290 million, and a non-GAAP net loss between $0.26-$0.28 per share.

Amazon

Amazon