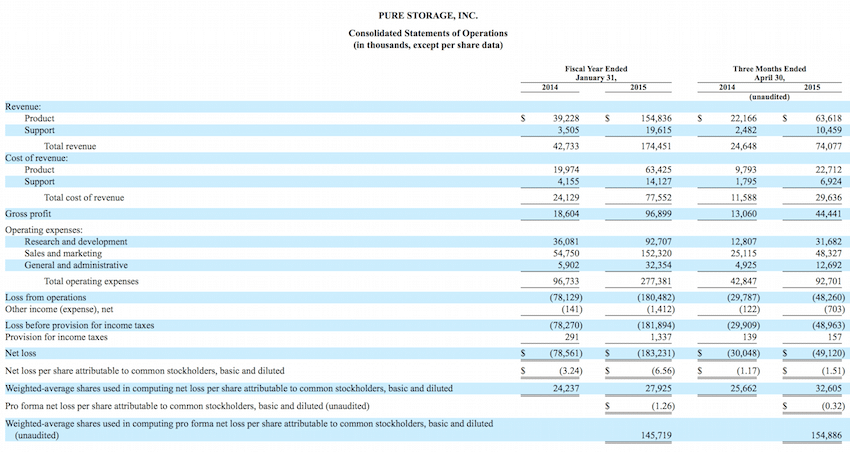

Yesterday Pure Storage started the process of going public, filing their S1 with the SEC. This process means Pure will soon have access to a large pile of cash, likely in the $300-400 million range by the time the issue starts trading. On the flip side the company now has to disclose all sorts of financial data including sales, marketing expenses and operational losses. This double-edged sword means the company extends their runway by a year and a half or so based on the current burn rate, but this also opens the company up for their competitors to pick on. That's exactly what happened when Pure revealed their product sales to be $154,836,000 for 2014 where Gartner had posted data showing revenues of $276,329,000 for 2014. It took Twitter only minutes to react, calling out the gaping difference of over $120,000,000 for 2014, and a gap of roughly $75,000,000 for 2013.

As a point of clarity, Pure Storage reports on a fiscal year that ends January 31st, where the Gartner data is based on calendar year. This minor difference is not entirely relevant given the gap, but one worth noting for data accuracy. Gartner also tracks product revenue only, not services or support.

Pure Storage Income Statement from the S1 Filing

The immediate question then is what happened and who's to blame. For Gartner's part, Joseph Unsworth made this statement about getting the numbers wrong and provided details around Gartner's methodology:

Simply put: I got it wrong. I have already been working on restating market share and that will likely happen next week. This is Not an excuse, just an explanation.

Here is my methodology – We review all public comments about financials and have offline models on quarterly sales (bookings and product revenues) as well as system units all done at by raw capacity for every vendor. I am fortunate that I track the entire supply chain of Solid State Arrays: chips, SSDs and systems which allows me visibility into the supply chain (of course, this doesn’t help me know what is a PoC and what was actually purchased – a big challenge). Lastly, we speak to end-users daily and Pure is one of the leading vendors of interest with our customer base (evident through our inquiries but also analytics of end-users searching on Pure Storage on our website).

*We send all estimates to vendors for review and publish under Gartner estimates*. [emphasis not added]

Okay, so Gartner made a mistake, is owning it and will forever get Pure correct because from here on out Pure will have to disclose their numbers. But that's just part of the issue. The last statement Joseph makes is the one that most should have a problem with. It's evident that Pure didn't overtly lie in feeding Gartner incorrect data, but they still apparently didn't say anything about the inflated data during the process nor after it was made public. Pure has always been on the IPO track, so this lapse in judgment is bizarre, someone internal to Pure had to know this reconciliation would eventually take place. Either way here we are. The Gartner data was bad, Pure didn't say anything, and now they'll have to deal with the fallout at exactly the wrong time as shareholders look to cash out and competitors look to expose Pure Storage as untrustworthy.

We reached out to Pure for this story but did not get a response.

Amazon

Amazon