Backblaze has released its Q4 2025 Network Stats report, which provides insight into how traffic flows across its platform and what that activity reveals about modern AI infrastructure. This is the company’s second quarterly Network Stats publication, alongside its ongoing Drive Stats and Performance Stats series, and focuses on network-level behavior, including ingress, egress, bandwidth concentration, and regional activity across customer workloads.

Rather than presenting theoretical models, the report draws from production traffic observed by Backblaze’s Network Engineering team, which monitors how data flows into, out of, and across the platform over time. The goal is to understand how customer behavior and broader industry changes show up at the network layer. In Q4, AI emerged as one of the strongest drivers behind shifting traffic patterns.

A significant factor behind this shift is B2 Overdrive. Introduced in April 2025, it provides a direct, high-performance connection between Backblaze storage and neocloud compute environments used for model training, inference, and experimentation. With this in place, Backblaze now has visibility into how AI workloads move massive datasets between storage and compute, often in short but intense bursts.

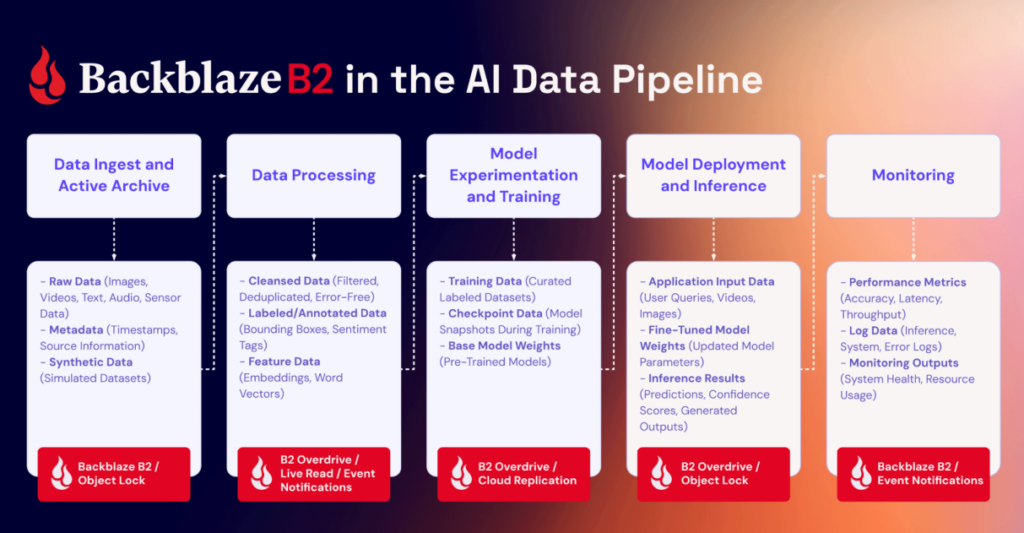

These workflows typically follow a familiar cycle: extensive collections of images, videos, and metadata are ingested and consolidated, then exported for training and experimentation. As models evolve, those assets are refreshed, updated, and stored again, creating recurring waves of high-volume traffic. Backblaze operates at both ends of this process, serving as the durable storage layer during ingestion and as the high-throughput source feeding downstream compute platforms. Once models are trained, they are stored, served, and periodically retrained, with Backblaze continuing to provide the underlying storage.

AI Workloads Are Driving Larger, More Concentrated Traffic Flows

During Q4, Backblaze recorded heavy traffic between its platform, neocloud providers, and traditional hyperscalers, concentrated primarily from June through November. This activity shows significant ingestion events followed by intensive processing and model-related data exports. As far as networking goes, this represents a shift from diffuse, internet-style traffic to fewer endpoints carrying much larger flows, a pattern that aligns closely with AI-centric infrastructure.

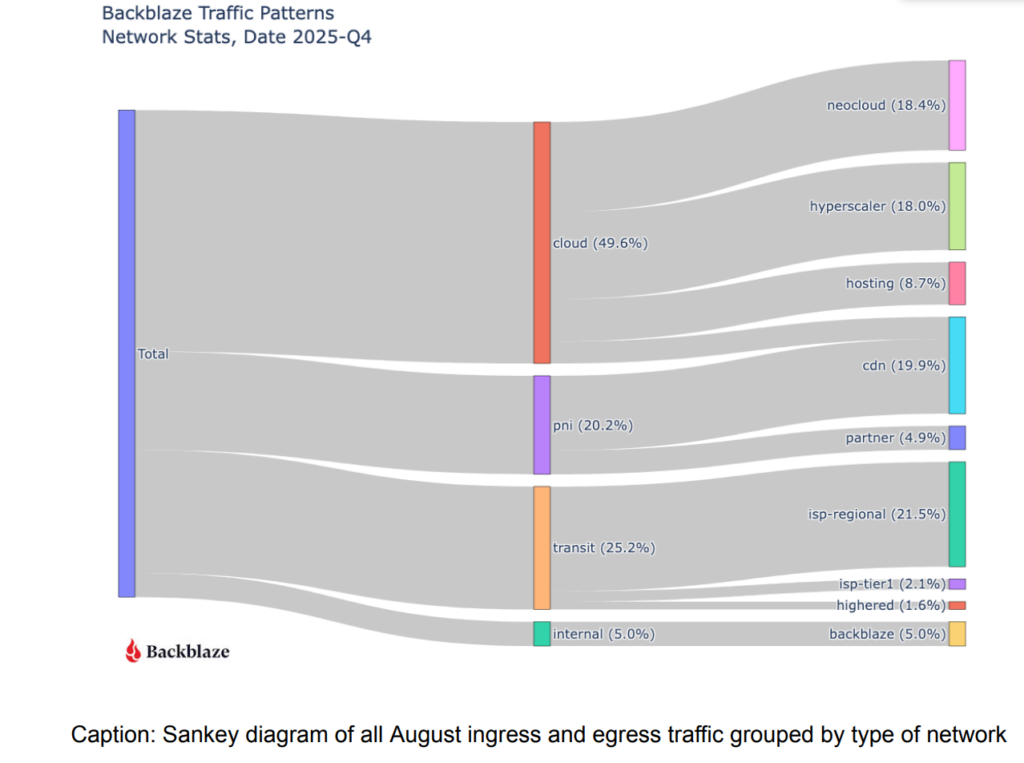

When traffic is grouped by network type, Backblaze’s report reveals several trends. Content delivery networks, hosting providers, and internet service providers remained largely within historical ranges, consistent with steady workloads for content delivery, web hosting, and backups. Two categories showed noticeable growth over the quarter.

Migration traffic increased from August through October, driven by large data transfers over private fiber connections within data centers. These links are used to efficiently onboard large datasets without relying on the public internet. At the same time, neocloud traffic rose noticeably from July through November (peaking in October), indicating increasing interaction between Backblaze storage and AI-focused compute platforms. BackBlaze says these changes suggest a higher baseline level of network activity is emerging.

To help frame the data, Backblaze also outlines its regional and network classifications. US-West is the company’s largest and longest-running region, while US-East shows the strongest proximity to the neocloud infrastructure. CA-East, located in Canada, is Backblaze’s newest region. Network categories include CDNs, traditional hosting providers, hyperscalers, regional ISPs that handle last-mile connectivity, Tier 1 ISPs that carry long-distance traffic, neoclouds focused on AI compute, and migration links used for large-scale onboarding.

Heatmaps Show Where AI Traffic Is Concentrating

Backblaze used heatmaps to visualize where AI-related activity is clustering across its regions.

Looking first at total traffic volume, US-West-to-regional-ISP connections dominate. This is expected given the size of Backblaze’s footprint in that region and its access to internet exchanges such as Equinix-IX, which bring Backblaze closer to consumer networks and reduce latency for everyday workloads.

More notable is the concentration of neocloud traffic in US-East, where flow data shows activity clustering around cities such as Chicago, Dallas-Houston, Denver, New York, Northern Virginia (including the Reston and Ashburn corridor), and Atlanta. This concentration in the eastern United States lines up with where much of today’s AI compute capacity is located. Shorter distances between storage and compute reduce latency, making it easier to move large volumes of data at high speeds. That proximity helps explain why so much AI-related traffic clusters in those regions.

Because this is the first quarter with a complete dataset, Backblaze notes that it is too early to draw long-term conclusions about whether these concentrations will shift. Tracking those movements over future quarters is now a key focus.

High-Magnitude Transfers Point to Sustained AI Pipelines

A second set of heatmaps examines “magnitude,” defined as the number of bits transferred per IP address. This metric combines volume with the number of participating endpoints, providing insight into the load on individual data flows.

High-volume traffic spread across many IPs is easier to distribute and balance across the infrastructure. High-volume traffic involving only a few IPs is more challenging, but also more revealing, since it reflects large, sustained transfers between specific systems.

With B2 Overdrive in place, Backblaze routinely supports client transfers ranging from 100Gbps up to 1Tbps. These high-magnitude flows are most prominent in regions serving AI-heavy neocloud endpoints, indicating that customers are actively moving massive datasets through the platform as part of their AI pipelines.

A third heatmap examines uniqueness, which BackBlaze measures as the number of distinct IP addresses involved in traffic. US-West shows the highest overall uniqueness, due to its larger number of data centers and broader mix of workloads. By contrast, Neocloud traffic typically involves fewer, more persistent endpoints. This pattern aligns with AI pipelines that rely on stable, long-running connections between storage and compute, indicating a broader shift toward sustained, high-throughput relationships between specialized systems rather than many-to-many communication.

Early Quarter-Over-Quarter Data Shows Rising Cloud-to-Cloud Movement

Q4 also introduces Backblaze’s first quarter-over-quarter comparisons, but this is the first full quarter of collected data since tracking began in August 2025.

Looking at the early quarter-over-quarter numbers, traffic going to other cloud providers jumped from 36.2% to 49.6%. Neocloud destinations slipped slightly, falling from 19.8% to 18.4%, while traffic to hyperscalers increased significantly, rising from 3.5% to 18%. Backblaze notes that this data reflects its own customer mix and only a single quarter of sampling, so it is far too early to treat these shifts as broader industry trends. That said, they do observe an overall increase in cloud-to-cloud traffic, with the destination mix changing compared to the previous quarter.

Looking Ahead

Overall, Backblaze views Q4 2025 as an early look at what an AI-native network is starting to look like. AI-related traffic is showing up in larger, more concentrated flows, neocloud connections have become a key part of how data moves, and data gravity is pulling storage, compute, and network architecture closer together.

The next quarter will be the first with a full quarter-over-quarter comparison, enabling a more in-depth look at how these AI-driven flows evolve. Backblaze also plans to examine areas such as IPv4 versus IPv6 traffic, cross-cloud connectivity trends, and additional concentration analysis as more data becomes available.

Amazon

Amazon