IDC has produced its latest version of the Worldwide Converged Systems Tracker for Q4 2022, with results keeping VMware as the dominant player in the HCI Software market, with 41.1 percent of the global market and an 11 percent growth in YoY revenue. Nutanix is still the number two player, with 24.8 percent of the worldwide market and a YoY revenue growth of eight percent.

| HCI Software Vendor |

2022 Annual Revenue (in $ Millions) | Market Share | 2021 Annual Revenue | Year-over-Year Revenue Change |

| VMware | $4,222.75 | 41.1% | 3,814.07 | 11% |

| Nutanix | $2,551.46 | 24.8% | $2,361.11 | 8% |

| HPE/H3C | $748.04 | 7.3% | $716.04 | 4% |

| Rest of Market | $2,751.88 | 26.8% | $2,473.07 | 11% |

| Total | $10,274.13 | 100% | $9,364.29 | 10% |

Source: IDC Q4 2022 Worldwide Converged Tracker dated March 2023. Worldwide Hyperconverged Systems Revenue Attributed to Owner of HCI Software

VMware continues to outpace the market and competition, showing 10.71 percent year-over-year growth from 2021 to 2022. VMware vSAN continues its upward trajectory as the most adopted HCI software, and VMware is the only vendor to surpass one billion dollars in revenue each quarter of 2022.

The introduction of vSAN 8 and the new Express Storage Architecture contributed to the steady increase in market share and revenue.

Nutanix placed second but had impressive growth in revenue and market share. The new management structure seems to be working. Nutanix is tops for support, with easy access to staff and resources. Nothing new in the appliance arena yet, but they have an impressive OEM partner list. The Nutanix software solution is still considered pricey compared to the competition.

HPE/H3C ranked third in this report. HPE is focused on GreenLake and Alletra platforms. HPE showcased new features for GreenLake during its GreenLake For Storage day, including file, block, disaster, and recovery data services through the HPE Alletra Storage MP. Incidentally HPE does also have an interest in HCI through the GreenLake platform.

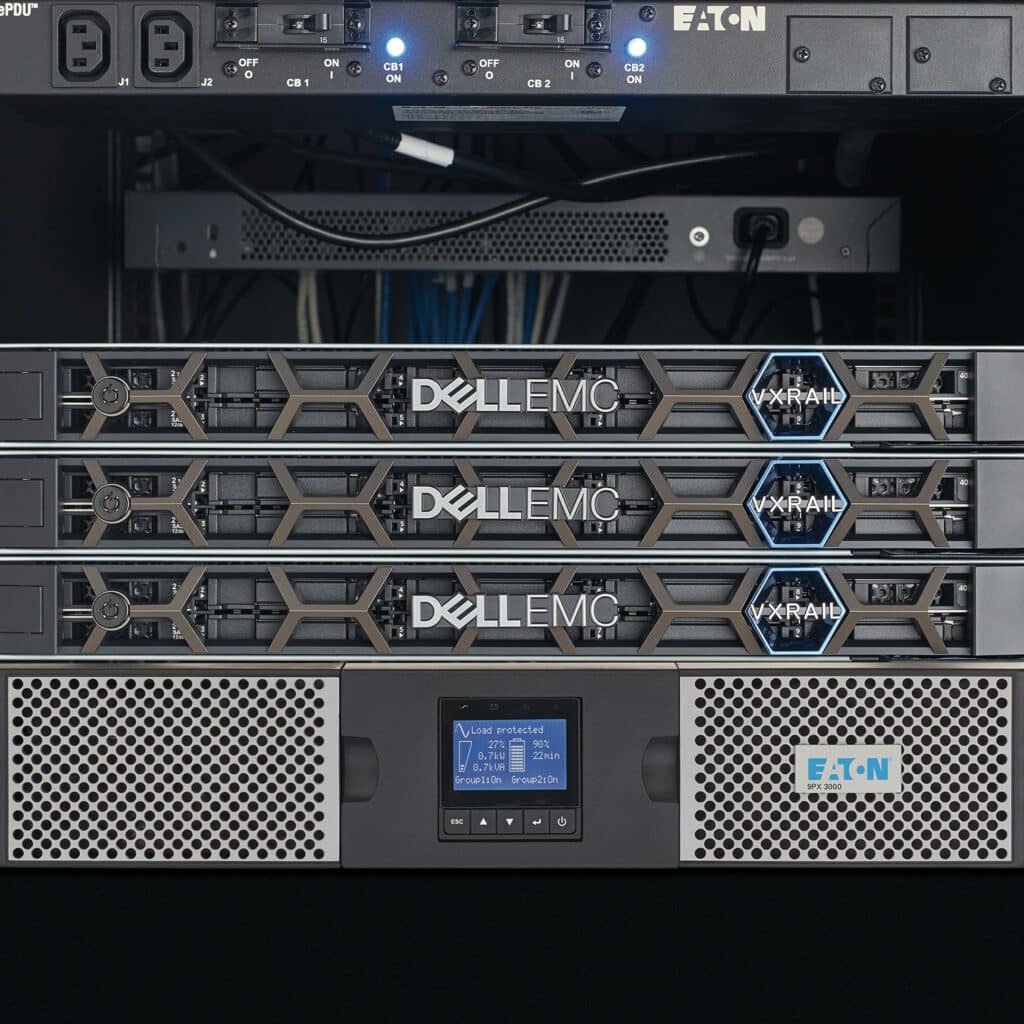

The HCI vendor space is growing rapidly, with over 20 vendors fighting for a piece of the HCI market. However, the market share and revenue growth through 2022 are only slightly greater than Nutanix. The other vendors lumped into the “Rest of Market” includes Cisco, Dell, Lenovo, Scale Computing, and others.

The HCI market continues to grow as data collection becomes even more critical, given the interest in developing AI solutions. It will be challenging to knock VMware off the top spot with its solid install base and continuing partnership with Dell.

Amazon

Amazon